Gold IRA Investing Guide

A gold self directed individual retirement account IRA, or precious metals IRA, is an IRA that includes IRS approved precious metals, including gold, silver, platinum, and palladium. Designed and Maintained by Digital Resource. Disclaimer: This is sponsored content. Additionally, the company offers a “no questions asked” buyback program, which can be beneficial for those looking to sell their precious metals quickly. During the maintenance window, impacted systems may be down or experience periods of unresponsiveness. The minimum required investment when opening a gold IRA account varies depending on the company in question. Gold IRAs are tax deferred investment accounts and must adhere to IRS regulations. Gold IRA companies might recommend specific custodians. The information on BMOGAM Viewpoints could be different from what you find when visiting a third party website. But today these paper assets can seem too risky for some people, especially after events like the Great Recession, which led to many people’s retirement accounts being significantly reduced over a very short period of time. Palladium Bullion Bars99.

6 Patriot Gold Club: Best For Long Term Savings Plans

The companies on our list work with financial institutions that provide custodial services for customers. Noble Gold frequently works with financial agents, certified public accountants, and estate planning attorneys. However, unlike traditional IRAs which focus on paper based assets such as bonds, EFTs, funds, stocks, and other cash equivalents, gold IRAs only hold physical gold or other approved precious metals. Second, you would instruct your representative here at Endeavor Metals to initiate a buy or sell order from your IRA. GoldBroker offers a comprehensive suite of options to help customers diversify their retirement accounts with precious metals. Depending on your age, current financial position, and personal preferences, the answer to this question will vary per person. There is also the issue of counterfeits. One of the main advantages of using Birch Gold Group over other providers is its commitment to transparency throughout the entire transaction process which starts with quality assurance checks on every item purchased before delivery takes place—ensuring authenticity of each product received by customers no matter what type of asset class chosen coins/bars. Conventional banks and brokerages get paid handsomely for trading paper, so they limit their customers’ choices. After all, the metal was delivered back out of an unallocated account, which means it could have originally come from any other dealer and any other customer. They don’t just sell you gold and then leave you on your own. I wired the funds for a recent transaction. Mint strikes these coins in one troy oz. This representative helps you open your new gold IRA account and guides you through the gold IRA rollover process to move funds from your traditional IRA or 401k to your new retirement account vehicle.

Why People Should Invest in Precious Metals

You should look for a broker or custodian with a good track record and one that is familiar with the gold and silver backed IRA market. It is important to look for a lender who is experienced in handling gold backed link IRAs, and who has a good track record of customer satisfaction. A silver IRA rollover is the process of transferring funds from an existing IRA or 401k into a self directed IRA that invests in physical silver. Information contained on this website is for information purposes only. Silver coins minted in 1964 and earlier commonly referred to as junk silver coins; silver bullion coins, which have a silver fineness of. First, this will introduce a technological solution that includes an immutable ledger of transactions, so potentially, compliance can be faster and easier.

Buy Platinum

Fees often vary depending on your situation, so ask an employee for a complete list of fees. Gold and silver were among the first known investments and served as a form of currency for centuries. Maximize Your Returns with Advantage Gold’s Customized Gold IRA Solutions Invest with Confidence Today. There’s a lot we liked about this firm. At this point, you should understand that a precious metals IRA is only one of several options for protecting your money from inflation and other economic downturns. Precious metals have been a popular investment for retirement plans since the financial market collapse in 2008. Rosland Capital cannot guarantee, and makes no representation, that any metals purchased will appreciate at all or appreciate sufficiently to make customers a profit. Upon receiving this confirmation from Delaware Depository, we will update your account accordingly. How BBB Processes Complaints and Reviews. The company has a long history of providing excellent customer service and has a strong commitment to providing the highest quality products and services. Discover the Benefits of Investing with Birch Gold and Secure Your Financial Future Today. GoldCo and American Hartford Gold Group offer a wide variety of gold investment options and a great customer service experience. Like gold, these precious metals must also be physical.

A Word of Caution: Do Your Due Diligence and Keep an Eye on Fees

Remember that withdrawals from your IRA are subject to tax laws. Ryan Sullivan, PEInvestment Advisor. American Hartford Gold Group has a strong reputation for offering competitive prices and high quality products, while Oxford Gold Group prides itself on its exceptional customer service. Even though this is not entirely negative, it might mean they’re motivated by selling and earning profits instead of genuinely caring about helping clients. Here are some of its key selling points. 9/5 Stars From 308 Reviews. But it would help to work only with the best gold IRA companies that will undoubtedly continue to deliver top quality service for many years to come. With a silver IRA, you can purchase physical silver coins and bars, or you can purchase silver ETFs or mutual funds. 25+ years in business, thousands of 5 star reviews, A+ ratings, competitive pricing, and low fee structure. American Hartford Gold works with families and individual precious metals investors. The company has a solid reputation and is committed to providing quality products and services.

1 Augusta Precious Metals: Editor’s Choice Great Gold IRA Company Overall 4 9/5

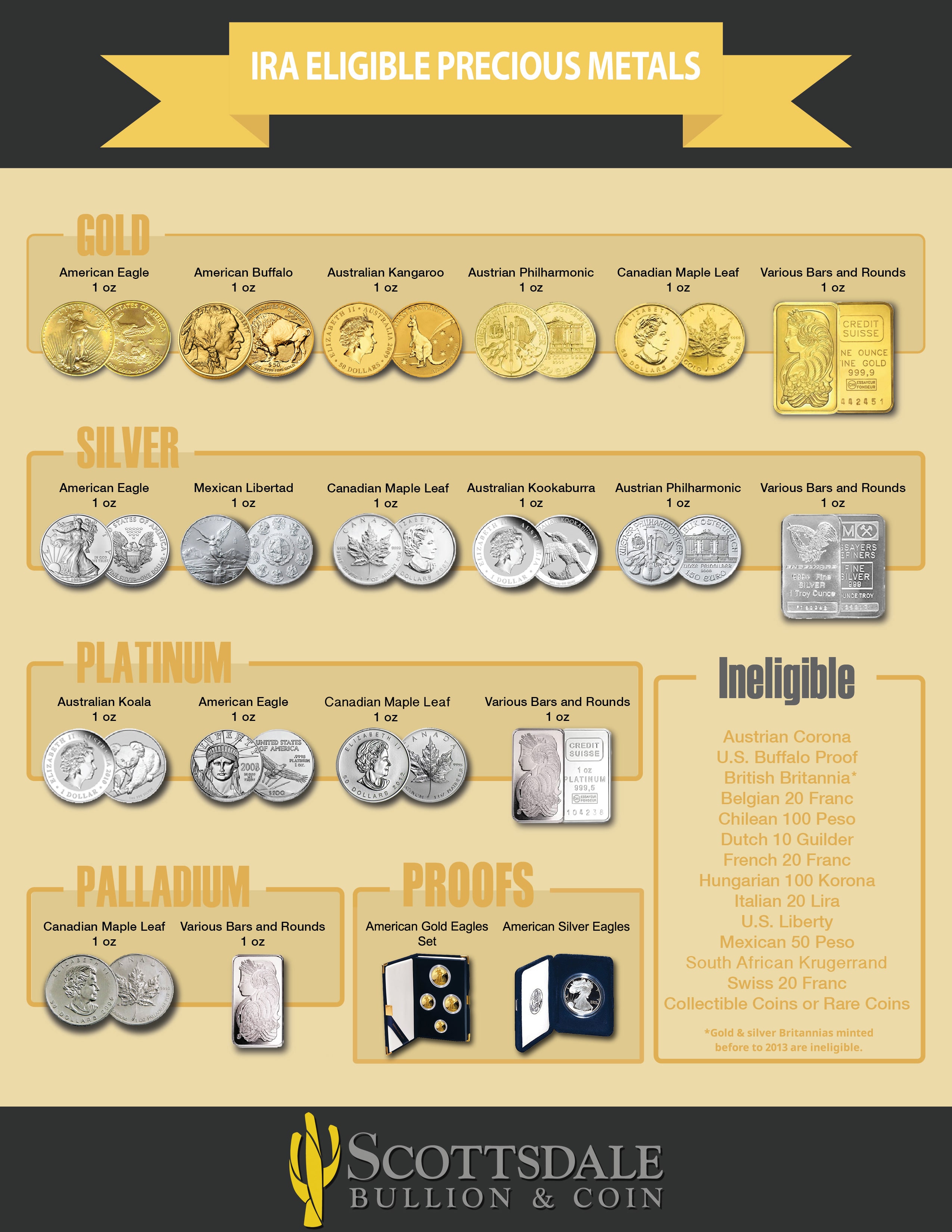

Under the statutory exception, IRAs can own certain precious metal coins and bullion, including. Experience Precious Metals Investing with Lear Capital Today. Augusta Precious Metals requires a minimum $50,000 investment for gold IRAs. Transparent product pricing is important for ensuring you get the best deal. Web Developed by HappyDesk. These can range from around $50 $100 but again it pays to shop around as prices vary between providers. Noble Gold representatives simplify setting up an IRA or rollover IRA.

Conclusion Gold IRA Custodians

In six years of operation, Summer Lawyers has grown rapidly to become one of the largest lending providers in Australia, acting across all states and territories. With Madison Trust’s Self Directed Gold IRA, you can invest in several types of metals, including gold, silver, platinum, and palladium. The best community banks are flexible, and may even offer a single “renovation perm” loan that lets investors buy and renovate a property, then shift into a long term landlord loan without refinancing first. Like the others on this list, Red Rock has strong ratings, and you can purchase IRS approved metals directly from the company. Owning and storing actual precious metals in a self directed IRA is an important and straightforward step toward true diversification of your investments. The best gold IRA companies can protect your retirement savings from rising interest rates, stock market volatility, and ever increasing inflation. Q: What is a Silver IRA. Most gold IRA companies have a similar structure, but each of them offers specific options, advantages, and disadvantages. You have two choices when it comes to withdrawing funds from your IRA. The IRS approved Silver IRA rollover method is entirely tax free.

IRA Gold Transfer

999 fine silver, ensuring their purity and authenticity. The amount of these taxes varies depending on the country you live in and the gold value. Investment District provides an opportunity to browse and choose from high end platforms and providers in the cryptocurrency, lending, precious metals, private equity/crowdfunding, and turnkey real estate asset classes. The guide looks at the fees associated with gold IRAs, the security of the company, customer service, and other important factors. A: A gold IRA custodian can hold a variety of precious metal assets, including gold, silver, platinum, and palladium. This system evaluates companies based on various factors, such as customer service, fees, gold selection, and more. It happened, for example, during the Great Depression.

Excellent Customer Service

No home safes or lockboxes. Do customers have a positive experience when dealing with the company. Any actions taken or obligations created voluntarily by the persons accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. >>>>Request Free Investment Kit With GoldCo<<<<. They also stand by their Buyback Commitment, without any liquidation fees. Experience Luxury With GoldCo: Elevate Your Lifestyle Today. This mix of precious metals has been picked with particularly the unique needs of clients in mind. If you're in search of an alternative to mutual funds and other funds in your retirement account, gold IRAs might be worth considering. Gold IRA investors are charged 1% of the total asking price for the investments, or $15, whichever is lower. 5% pure or better and silver bars must be 99. The Birch Gold Group team usually includes different specialists including financial advisors, wealth managers, and commodity brokers. The No Fees for Life IRA can help you save a lot on fees compared to other gold IRAs. Some of the company's perks include no fees for the first year of the account, no storage fees, and a great selection of coins. Your Loan Officer will review your financial information and determine if refinancing is the best option.

We verify companies and reviewers

Their commitment to customer service and education makes Lear Capital a reliable choice for those interested in investing in a silver IRA. When you purchase precious metals for a gold IRA, you must store them in an IRS approved depository which typically involves a fee. 7 Other returns of numismatic items outside the thirty 30 day return privilege may be subject to a restocking fee of up to 20% or repurchase at First Fidelity Reserve’s buy price at the time of return. For instance, IRAs allow individuals over age 50 to contribute additional funds beyond what is allowed by regular limits while 401k rollovers provide tax advantages that make them attractive alternatives to conventional savings plans. Risk Disclosure Privacy Policy Accessibility Terms and Conditions. Clients can ship their gold and silver to the depository they choose after opening their gold and silver IRA. This family owned business accomplished this by implementing a relatively simple and transparent fee system for their clients to view and pursue, establishing them as one of the best gold IRA companies. By selecting a trustworthy lender, you can rest assured that your investment is in good hands and that you’re on the path to a secure financial future. Clients who are planning for their retirement often spend some time learning about their options, so they might know they can open traditional IRAs. Gold retirement accounts were introduced in the investment market starting in the late 1990s. With a gold IRA, you can take advantage of the many benefits of investing in gold, including diversification, security, tax advantages, long term growth potential, protection against inflation, and liquidity. The only distinction between a gold IRA and a conventional IRA is that physical precious metals constitute the invested assets in a gold IRA.

Johnson Matthey Silver Bar

Selling your car or jewelry often does not take long, so if you had to sell one car in order to make mortgage payments, you could do so in a reasonable amount of time. One of the main advantages of using Birch Gold Group over other providers is its commitment to transparency throughout the entire transaction process which starts with quality assurance checks on every item purchased before delivery takes place—ensuring authenticity of each product received by customers no matter what type of asset class chosen coins/bars. The role of the depository is to hold and protect the precious metals, and to provide periodic statements and valuation reports to the custodian and the IRA owner. Invest in GoldCo for a Brighter Future. TUH Union Health Silver+ Family, $235 per month. Service: 866 928 9394.

Contact Us

When selecting a gold IRA custodian, it is important to ensure that they have the experience and expertise to provide a secure and efficient gold IRA rollover. To help you get started, we have outlined the three primary steps involved in opening and running an account with them. However, finding a legitimate loan lender is crucial to ensure the safety and security of your investment. >>> Click here for Free Gold IRA Kit <<<. The amount required varies depending on the custodian you choose, the types of assets involved, and other factors related to setting up the account – which means that even those with limited capital may still be able to open one. The interest rate on these loans starts at 6. Those who prefer to do business face to face with a home mortgage consultant will find Wells Fargo's extensive branch network attractive. These are also known as precious metals IRAs. Unlike traditional account types, IRAs allow people to invest in physical precious metals. It's probably the most popular gold IRA company out there, and it's due to good reason. $75 for a purchase or liquidation. The custodian could have partnerships with certain dealers, but you're free to find a reputable dealer on your own. For those interested in diversifying their portfolio beyond just stocks and bonds but aren't sure where to begin with investing in gold IRAs, look no further than Goldco. Unlike traditional account types, IRAs allow people to invest in physical precious metals.

CONS

Gold Bars: They must have a purity of 24 karat 0. Invest in Gold with GoldBroker and Secure Your Financial Future. Silver bars and also 1000 oz. Whether you are a new investor or an experienced one, taking the time to research and select a reputable company can make all the difference in your investment success. To begin, the first thing you will need to do is fund your account. As with any investment, it is important to do thorough research and consult with a financial advisor before making any investment decisions.

SEE OUR YELP REVIEWS

GoldCo’s gold IRA custodians are also committed to providing customers with the highest level of customer service. Augusta can also be an intermediary between the client and the custodian. However, people that purchase large quantities of gold for their IRA may get their fees waived off for the first 3 years. BBB: A+ From 72 Reviews. Minimum purchase/funding requirements can vary per company, but set up costs, storage fees, and annual fees typically exceed $100 although you’ll pay less in set up costs at some platforms. Patriot Gold’s commitment to quality and customer satisfaction is evident in its commitment to providing the best gold IRA companies in the market. The company typically offers four departments committed to delivering the best customer experience. Here are three options for funding your gold IRA. If you’re searching for gold and silver investment news, the company regularly publishes helpful articles and videos that educate their audience about precious metals investing. The content of each kit can vary and change.

OpinionesColombia

WARNING: This comparison rate is only true for the examples given and may not include all fees and charges. A Total Asset Protection IRA allows you to make investment decisions entirely on your own, based on your personal interests. Their customer service level is second to none. Unallocated storage usually costs less than allocated. Investors who prefer Silver Eagles should ask about backdated Silver Eagles before putting current year Silver Eagles in their IRAs. 5% pure from a reputable dealer make the best gold for IRAs. The team at Augusta Precious Metals is highly knowledgeable, providing customers with the necessary information to make informed decisions. The brokerage offers an expanded range of investments via registration with the world’s largest derivatives marketplace. Invest in a Secure Financial Future with Birch Gold. Unlike other investment options, you get to own physical gold, which is where the benefits lie. Unlike traditional IRAs, which limit investments to stocks, bonds, and mutual funds, a silver IRA allows individuals to diversify their portfolios by including precious metals.

The Basics of Precious Metal IRAs

GET STARTED WITH ON OUR ONLINE APPLICATION HERE. They’ll have to fill out forms with their information, create an account, select the best products, and invest in them. You can begin taking distributions at age 59 ½ and must begin taking minimum distributions at age 72. As the price of gold increases over time, so will your holdings’ value. The study draws from the historical record to show why many view gold as an investment for all seasons. They’re convenient too because precious metals have been historically valuable and will continue to be so in the future. Do you want to open a Precious Metal IRA account but are unsure where to start. Visit American Hartford Gold’s Website.

Types of gold you can hold in a precious metals IRA

Delays in order processing and delivery. Doing research and considering factors such as ratings, fees, and customer service can help ensure that the account is managed properly and securely. Augusta Precious Metals, based in Los Angeles, brands itself as “Your Premiere Gold IRA Company,” and I couldn’t agree more. As a result, commissions and profits often drive their recommendations. Investing in a metals IRA would have been able to offset losses on other investments. 9% pure silver or better. If you wish to set up and fund an IRA with silver, you should know that you will not be able retain physical possession of the metals yourself. This coin has been widely accepted throughout Europe due to its popularity among collectors worldwide and its beautiful design. You can roll over existing retirement accounts into a gold IRA, and gold IRAs offers perks like diversification outside of stocks and protection against inflation.